To establish a presence as a foreign company in Italy, one of the initial steps is to open a liaison office in Italy, often referred to as a representative office. This entity is known as Ufficio di Rappresentanza. It is the most straightforward way for a foreign entity to expand its operations into the Italian market. The primary purpose of a liaison office is to provide support to the parent company in marketing efforts and business development activities within Italy. To facilitate this process, it’s advisable to seek assistance from our specialists in company formation in Italy.

| Quick Facts | |

|---|---|

| Purpose of a representative office in Italy | A representative office in Italy serves as a non-commercial liaison for a foreign company. |

|

Registration |

– prepare documentation, – request tax code, – register at Companies Register, – appoint key agent for representative office, etc. |

|

Residency requirement for agent (YES/NO) |

NO, but the agent must have an Italian Tax ID |

| Activities of a representative office |

– promotional activities, – market research, – product showcases, – networking, – trade shows participation, etc. |

| Interdicted activities |

– selling goods or services, – sign contracts, – import and export, – make investments, etc. |

| Can hire employees (YES/NO) |

YES, and we can help with payroll services in Italy for your office. |

| Related costs |

– utilities, – rent (if applicable), – employees salaries, – office supplies, – maintenance, etc. |

| General documents required to open a liaison office |

– ID documents of the representative agent, – Tax ID of the representative agent, – boards of directors’ statement, – parent company’s business profile, – power of attorney, etc. |

| Language for documents |

Italian |

| Differences from a subsidiary | A subsidiary has an independent management, can conduct commercial transactions, and has financial liability, while a representative office operates under the parent company’s direction, lacks financial autonomy and cannot perform profit-making activities. |

| Differences from a branch office |

A branch office is a legal extension of the parent company, capable of engaging in commercial activities, whereas a representative office has non-commercial functions and cannot conduct business on its own. |

| Transitioning to another legal entity (YES/NO) |

Yes, our specialists in company formation in Italy can provide support in this process. |

| Alternatives |

– branch office, – subsidiary |

| Advantages of opening a representative office in Italy |

– cost-efficient way to research a new market, – easy registration process, – networking with potential business partners, – creates brand awareness, etc. |

| Assistance and additional services |

Our team can help you if you want to open a company in Italy or a liaison office. If you need guidance on tax-related matters, our partner accountants in Italy can provide support. |

| VAT | Representative offices are not subjected to VAT. |

|

Laws governing liaison offices in Italy |

– Italy’s Income Tax Consolidated Text, – OECD Model Tax Convention on Income and on Capital |

|

Time frame for opening a representative office |

1 week |

| Bank account | Not mandatory, but recomended |

| Physical representation required for incorporation (YES/NO) |

NO, our specialists in company formation can help you open a liaison office without having to be physically present in the country. |

| Management |

Under the parent company |

| Minimum capital required |

Not applicable |

| Liability |

The parent company holds full liability for the office’s actions and debts. |

| Accounting |

Not applicable |

| How to obtain an Italian Tax ID | From the Italian consulate or embassy in the country of the parent company or in Italy, at the Italian Revenue Agency. |

| Secretary required (YES/NO) |

NO |

| Representative office name |

Same as the parent company’s |

| Minimum/maximum number of employees |

No prescribed minimum/maximum requirements |

| Best suited for |

Companies seeking to establish a presence in Italy, but with no intention of engaging in commercial activities. |

| Why choose our company incorporation agents |

– complete assistance, – affordable prices, – expertise and experience, – familiarity with local regulations, etc. |

Table of Contents

Advantages and disadvantages of a liaison office

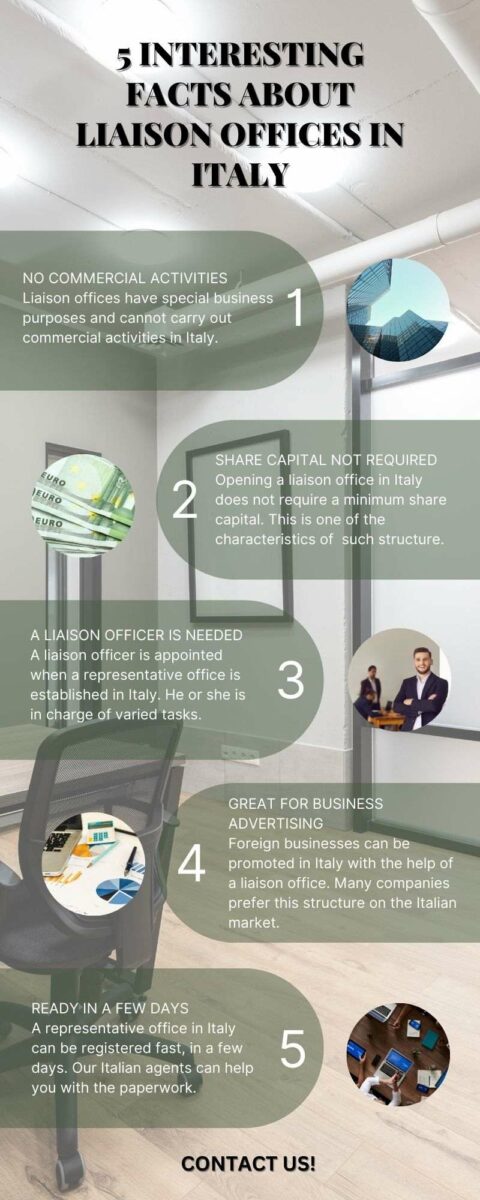

The most important fact a foreign company must know regarding a liaison office is that it is forbidden to perform commercial activities that could generate profit. As in some cases, it can be a disadvantage, the main advantage is that all the costs generated by the representative office are fully deductible for the foreign company. As such, if a company wishes to perform an accurate market research before starting investments in a new country, a liaison office represents the cheapest method of doing so.

Another important advantage of opening a representative office in Italy rather than a branch or subsidiary is that the representative offices in Italy are not obligated to register with the Trade Register or submit articles of association. Moreover, as it is not viewed as being a legal entity, but an extension of the foreign company, the liaison office does not have to file financial statements and does not require a minimum share capital in order to function.

Those who want to set up a business in Italy have the support offered by our local agents at their fingertips. They can explain the establishment formalities and take care of them so that the entrepreneurs can focus on the investments and activities they have to undertake. A company cannot enter the market without a bank account, registration for the payment of taxes, and the necessary licenses, so our team can also help you with these steps. Get in touch with us to benefit from personalized services and also discover the following infographic:

The limited activities a liaison office can perform

A liaison office in Italy can perform a limited number of activities, as it is not an Italian taxpayer. A representative office can take promotional actions, but can also do marketing research and data gathering. In addition, it can store, display or deliver goods that belong to the parent company.

A representative office in Italy is also a great way to build and maintain relationships with potential clients, partners, and suppliers. This can involve attending meetings, negotiations, and communication on behalf of the parent company.

It can represent the parent company at trade shows, exhibitions, and industry conferences. This helps in enhancing the company’s visibility and reputation within the Italian market.

We can help you open a company in Italy if you are looking to conduct commercial operations that a liaison office cannot perform.

Costs generated by opening a liaison office

Like any other business undertakings, opening a liaison office in Italy involves different costs, such as a yearly government tax, that must be deposited at the Chamber of Commerce. A representative office in Italy does not engage in profit-generating activities and is not subject to any taxes. Its costs primarily involve the expenses related to its establishment and day-to-day operations

These can encompass: office rent, utilities, office supplies, communication expenses, and any salaries for employees. The actual expenses will depend on the size and location of the office.

It is also not required to fulfill certain reporting or compliance obligations, such as submitting annual financial statements or fulfilling regulatory requirements.

For tax-related matters, our accountants in Italy can provide full assistance.

If you have a business and want payroll in Italy, our specialists are at your disposal. The calculation and delivery of salaries, the preparation of the necessary documents in this endeavor, the collaboration with the relevant institutions, consulting, and reporting to the management are some of the attributes of our experts. It is good to know that we are aware of the legislation and the changes brought by the law in order to be able to correctly implement the required measures.

How to register a liaison office in Italy

Registering a liaison office in Italy is far from a complicated procedure. The representative and a special attorney must make the first step and it consists of requesting a tax code from the local Tax Office. After the tax code is obtained, the representative must register his presence at the liaison office to the Companies Register in order to be recorded in the Inventory of Economic and Administrative. These steps do not take longer than two weeks to be completed.

A representative office in Italy does not have legal status, and therefore, it does not require a notarial deed for its establishment. Additionally, there is no minimum initial share capital requirement.

The parent company must provide an address in Italy for the representative office. This address serves as the official location of the office.

The parent company must appoint a key agent for the representative office. This agent can be either a resident or a non-resident in Italy. However, regardless of their residence status, the appointed agent must have an Italian Tax ID (Codice Fiscale).

We can provide assistance regarding company incorporation in Italy if you decide to open another type of company in the country.

Documents required for opening a liaison office in Italy

Some of the documents required for the registration of a representative office in Italy include:

- Power of attorney: A signed power of attorney must be provided in case you choose our specialists in company formation in Italy to enroll the representative office at the relevant authorities;

- Business profile of the parent company, as released by the Company Register of the parent company’s home country;

- Passport copy of the person who will be appointed as the legal representative of the liaison office in Italy.

- Board of directors statement: A statement issued by the board of directors of the parent company, appointing the individual (and providing his/her personal data) who will serve as the legal representative of the representative office in Italy;

- Tax code of the legal representative of the liaison office.

Documents must be translated into Italian by a sworn translator. Additionally, they must be authenticated with the apostille procedure by a notary in the country of the parent company or by the Italian consulate or embassy in the foreign country.

These documents are essential for the registration process and legal establishment of a representative office in Italy. We can also provide details regarding the documents you need to start a company in Italy, such as a joint-stock company.

We also invite you to watch a short video on the representative office in Italy:

Our team can help you open a liaison office in Italy and they will also provide all the necessary information on virtual offices. Contact our agents in Italy and they will help you with all the details regarding the company formation process.