The limited liability company or the SRL as it is commonly referred to is the preferred type of company in Italy. Investors who want to register a SRL in Italy need to observe the mandatory steps and follow the applicable company incorporation procedure. Our company formation agents in Italy can help international entrepreneurs set up an SRL in this country.

Table of Contents

Features of SRLs in Italy

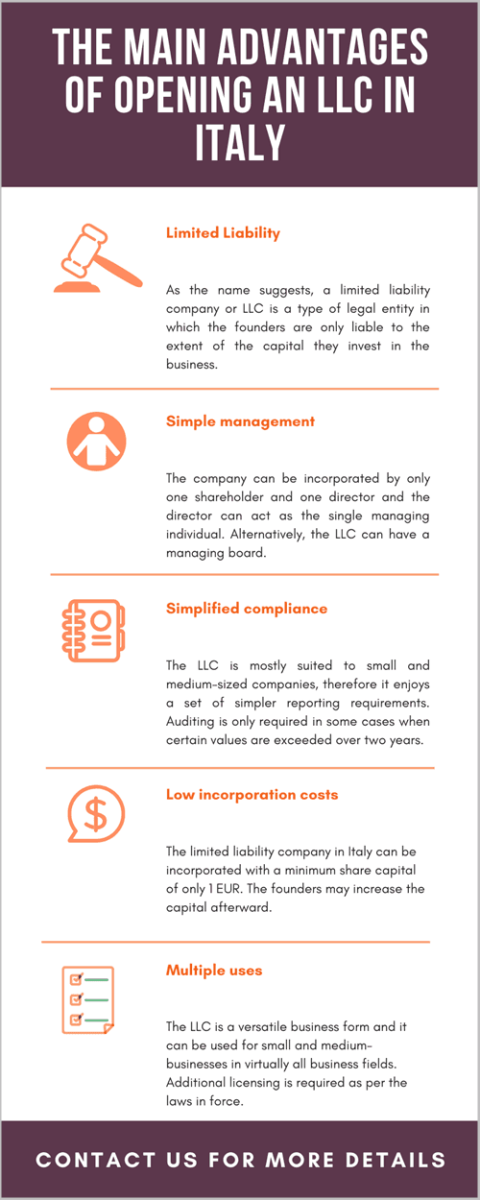

The SRL in Italy is a legal entity, meaning that its identity is separate from that of its founders and the shareholders are only liable to the extent of the assets invested in the share capital. The main traits of the SRL are as follows:

- Limited liability: the liability of the shareholders is limited only to the amount they have invested in the company.

- Low minimum share capital: at least one euro is needed to incorporate the SRL and the simplified SRL.

- Forms of management: this can be insured by a single managing director or a board of directors.

- Auditing: only in some cases for the SRL when the total assets, the sales, and services revenue or the average number of employees exceeds certain values/limits for a period of two consecutive years.

In the case of a simplified SRL in Italy, the shareholders can only be physical persons. Companies are not accepted as shareholders in such a structure. Moreover, a simplified SRL needs to adopt the standard Italian laws and regulations, referring to business activities and internal rules.

Types of Italian limited liability companies

There are three types of limited liability companies that can be registered in Italy in 2024:

- the private limited liability company (SRL);

- the simplified limited liability company (SRLS);

- the public limited liability company (SPA).

The SRL and the simplified SRL share many characteristics, however, there are a few key differences investors should be aware of: the simplified form cannot have a share capital of more than EUR 10,000 and cannot be incorporated by another legal entity, only by an individual. As far as the shared characteristics are concerned, both the SRL and the simplified SRL are the same in the following respects: they both need only one shareholder and one director who can be the same individual and need not be a resident, they must have a registered address in Italy and are incorporated via an incorporation need in front of a public notary.

Our company formation agents in Italy can help foreign investors in setting up any type of limited liability company, following the procedures for 2024.

If you need to open a corporate bank account in Italy, you can contact our local specialists.

According to recent Company Law modifications, foreigners can now register an SRL in Italy with the help of a virtual meeting with the public notary and dedicated platforms. There are specific identification procedures for shareholders, plus the authorization of digital signatures.

The features of the SRL in Italy

Those who want to open a SRL in Italy must keep in mind the following requirements imposed by the Company Law:

- the company is incorporated by at least one shareholder and one director;

- the company’s name must contain the abbreviation SRL or SRLS in the case of the simplified LLC;

- the minimum share capital required to open an SRL is 10,000 euros; however, there is also the possibility of setting up a SRL without a minimum share capital requirement provided other requisites are met;

- the limited liability company must have a registered office in Italy.

In the case of single-shareholder SRLs, the share capital is to be paid in full before the registration. Our company registration agents in Italy can give you more details about the capital obligations. Our local advisors can explain the requirements for setting up an SRL and can assist you in handling all of the registration phases.

Foreigners who want to open a company in Italy are advised to consider specialist help from our local agents. They can be guided regarding the formalities involved in the chosen structure. It will be necessary to draw up and sign the documents, open a local bank account, as well as register for the payment of taxes.

The costs for opening an SRL in Italy can implicate the Trade Register fee of around EUR 250, the incorporation cost of about EUR 2,300, and, if solicited, the cost of a virtual office of approximately EUR 100 per month.

Requirements for registering an SRL in Italy in 2024

Contributions can be made both in cash and in-kind unless otherwise specified in the company’s Articles of Association. The share capital must be made up of the shares issued to each shareholder. Our company registration agents in Italy can give you further details about the rights and liabilities of shareholders. Here are other SRL requirements you should consider:

- Business owners who operate in certain sectors will need to obtain special permits and licenses to run their businesses. Our agents can help you apply for these permits and fulfill other requirements for performing specific business operations in Italy.

- The Italian Business Register, with which all companies are required to register, is under the management of the Chamber of Commerce. Investors can perform a business check by searching the online portal and accessing the public information on an SRL.

Visura is the Certificate of Incorporation of an SRL in Italy, issued at the time the formalities are finished and approvals issued. This kind of document must comprise the fiscal code and the VAT number and can be issued in about 3 days.

SRL management in Italy

A company director is the one who must manage the company accordingly, perform any necessary business transactions, and make sure that the company meets its business goals.

The appointment or revoking of company directors takes place during a shareholder’s meeting. Any other important decisions regarding the company (such as amendments to the statutes or capital increases and decreases) are taken only by the company shareholders during their meetings. Shareholders have administrative and economic rights based on their shares in the company. However, special rights for management and the distribution of profits can be granted to shareholders in the articles of association.

If you need payroll services in Italy, we suggest you contact our specialists to get a concrete idea of what this type of service entails. Salary calculation, payroll tax calculation, and salary delivery are some of the most important procedures related to payroll. We advise you to choose the outsourcing of these services and benefit from affordable costs and various offers.

SRL taxation in Italy

The corporate income tax, the value added tax and the regional tax on productive activities are the main types of taxes imposed in Italy. The corporate tax, or IRES, has a value of 24% to which the regional tax on productive activities, the IRAP, applies. In general, this tax has a value of 3.9% and it is collected by the Italian Region in which the company engages in business activities. The IRAP applies to companies that produce goods or offer services, both in case of resident and non-resident commercial companies. However, in case of non-resident companies, the IRAP will apply only if the permanent establishment has been conducting business activities for at least three months in a certain Region.

The value added tax applies to the provision of goods and services, with some operations being tax-exempt. The standard VAT rate in Italy is 22%, with reduced rates of 10%, 5%, 4%, and 0% (for the export of goods, the provision of international services related to international trade, the transfer of goods to other EU states and the provision of certain services related to the transfer of goods within the EU). One of our agents who specializes in company formation in Italy can give you updated information about the changed ordinary and reduced VAT rates.

Apart from the main taxes mentioned above, Italy also imposes a set of municipal taxes:

- the property tax: applied on a municipal level for the ownership of buildings, buildable areas as well as agricultural lands;

- stamp duty: levied on certain types of legal and banking transactions, with varying rates.

- social security: mandatory for the employer, the value varies according to the type of job.

The Italian Tax Agency is in charge of issuing the codice fiscale (Italian tax code) for limited liability companies in Italy. The procedures can be managed by one of our local agents who collaborate with the respective authority. Moreover, we can act in this sense with a power of attorney, representing the business owner and/or managers.

Investors who want to open a company in Italy in 2024 and need updated information about the applicable taxes, as well as the registration requirements, can reach out to one of our agents. We can provide complete details about the requirements set forth by the Ministry of Finance.

We invite you to watch a short video about opening a limited liability company in Italy:

Accounting for companies in Italy

A SRL in Italy needs to observe the accounting principles in Italy and observe the requirements for preparing and submitting annual accounting and financial records. A general ledger, an inventory book, and other documents are the accounting books that must be kept by an Italian company.

The annual financial statements required by law for an Italian company include the balance sheet, the profit and loss account, and notes to the financial statements. The company’s assets and liabilities must be accounted for in these documents and they must reflect the true financial status of the company. Directors’ reports might also be needed, although SRLs in Italy are allowed to draw up abridged financial statements.

In some cases, a limited liability company in Italy needs to appoint a board of statutory auditors. A company in Italy must submit the annual corporate income tax returns within nine months after the end of the financial year. This can also be done electronically. The corporate income tax in Italy is paid in two installments and different rules apply for companies whose financial year does not correspond with the calendar year. In general, the first installment consists of 40% of the total amount of corporate income tax due for the previous year, with the second installment paying the remaining 60%. The first part is due by the end of the sixth month the following year and the second part is due by the end of the eleventh month the next year.

Our team can help you with accounting services for your company. We can also put you in touch with our foreign partners if you are interested in doing business in another country, such as UAE.

SRL advantages in Italy

Among the benefits of the SRL, we mention the following:

- the shareholders and the directors need not be citizens or residents of Italy;

- the shareholder can occupy the position of the company director;

- the SRL offers protection to the personal assets of the shareholders;

- the shares in the company can be transferred between the shareholders without any restrictions.

The company incorporation of an SRL in Italy takes around 7 days from the date the documents have been presented and submitted to the relevant authorities. Our local Italian agents can supervise the process and inform customers about the registration time frame.

Please contact our Italian agents for complete details and support if you are interested in registering an SRL in Italy in 2024.